Introduction to PayPal Cash Apps

PayPal cash apps have emerged as essential financial tools in the United States, enabling users to conduct transactions with remarkable ease and efficiency. These applications leverage the PayPal platform to offer a range of services, including money transfers, payment processing, and effective fund management. With the growing trend of digital transactions, these cash apps integrate seamlessly with PayPal accounts, enhancing users’ financial capabilities.

One of the primary advantages of utilizing PayPal cash apps is their ability to facilitate quick and secure transactions. Users can send and receive money instantly without the need for physical bank visits or lengthy paperwork. This is particularly appealing for individuals who frequently engage in online shopping, bill payments, or peer-to-peer transactions. Furthermore, the user-friendly interfaces of these apps simplify the navigation process, allowing even non-tech-savvy individuals to manage their finances effectively.

The increasing popularity of PayPal cash apps can also be attributed to their compatibility with other financial services. Many of these applications allow for integrations with banking institutions and debit or credit cards, providing users with a comprehensive platform for their monetary needs. Additionally, they often include features like budgeting tools, transaction tracking, and spending insights, which help users make informed financial decisions.

As digital wallets and cashless payment methods continue to gain traction, more people are turning to PayPal cash apps for their convenience and reliability. This section serves as an introduction to the world of PayPal cash apps, setting the stage for a detailed discussion of specific applications that stand out in providing seamless financial solutions. Whether for personal or business use, these apps offer users a viable alternative to traditional banking methods in the modern financial landscape.

Criteria for Selecting the Best PayPal Cash Apps

When choosing a cash app that integrates smoothly with PayPal, various key criteria must be considered to ensure that users have the best experience possible. First and foremost is user experience, which encompasses the app’s interface and overall ease of navigation. A well-designed user interface can significantly enhance the experience, making it simple for users to send and receive money without confusion. A seamless experience can lead to better user satisfaction and increased adoption rates.

Security features also play a critical role. Given the sensitive nature of financial transactions, it is essential to select apps that implement advanced security protocols. Features such as encryption, two-factor authentication, and regular security updates are vital for protecting user data and preventing unauthorized transactions. Users should prioritize apps that demonstrate a commitment to security by providing transparent information regarding their practices and compliance with relevant regulations.

Transaction fees represent another crucial factor. Different cash apps have varying fee structures, which can impact the overall cost of transactions. It is advisable to choose an app with minimal fees to maximize the value of services rendered. Understanding the fee structure helps users make informed decisions based on their transaction volume and frequency.

Compatibility with PayPal is a non-negotiable aspect in this selection process. An ideal cash app should smoothly integrate with PayPal, allowing for easy transfer of funds between accounts. This capability not only increases convenience but also provides flexibility in managing finances. Lastly, reliable customer support is essential. Access to prompt assistance can resolve potential issues quickly, ensuring seamless operation and enhancing user confidence in the app. By evaluating these criteria—user experience, security features, transaction fees, compatibility with PayPal, and customer support—users can make informed decisions when selecting a cash app that meets their needs.

Venmo: A Popular Choice

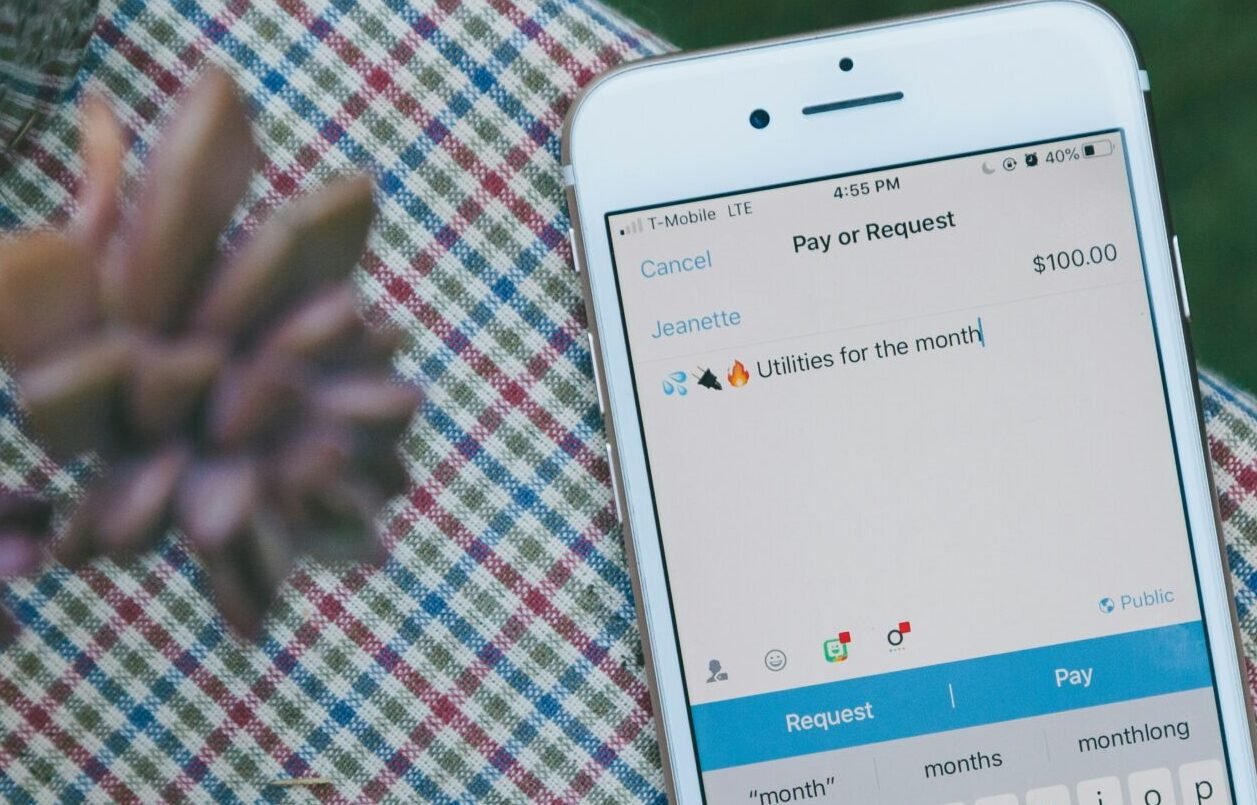

Venmo has established itself as a prominent player in the realm of cash apps that seamlessly integrate with PayPal. This app, designed primarily for mobile use, offers a straightforward interface that appeals to a wide range of users, particularly millennials and Gen Z. Its user-friendly layout allows individuals to easily send and receive money, making it a preferred choice for many. Sending funds can be accomplished in a few taps, and users can also attach notes or emojis to their transactions, adding a personal touch to the experience.

One of the standout features of Venmo is its ability to facilitate transactions between friends and family. As users engage in social interactions, such as splitting bills after dining out or settling a friendly wager, Venmo streamlines this process with notifications that show transaction histories. This social aspect not only enhances user interaction but also encourages more frequent usage among peers.

For those concerned about fees, Venmo does have a few considerations to keep in mind. While sending and receiving money from a linked bank account or debit card remains free, transactions made using a credit card incur a 3% fee. Furthermore, instant transfers to your bank account come with a nominal fee, which might deter some users from opting for rapid withdrawals. Nonetheless, by understanding these fees, users can better manage their finances and optimize their Venmo experience.

In terms of transferability to PayPal, Venmo provides a unique advantage as both services belong to the PayPal ecosystem. Users can easily link their Venmo account to PayPal, enabling straightforward transfers to and from their Venmo balance. To maximize the capabilities of Venmo, it’s beneficial for users to familiarize themselves with all features offered, ensuring they can leverage this cash app effectively for their financial transactions.

Cash App: Seamless Integration with PayPal

Cash App has emerged as one of the most efficient payment solutions available in the USA, particularly for users seeking seamless integration with PayPal. This application enables its users to effortlessly link their PayPal accounts, thereby facilitating a range of quick and secure monetary transactions. By connecting Cash App to a PayPal account, users can transfer funds rapidly, simplifying the overall payment process.

One of the standout features of Cash App is its user-friendly interface, which allows individuals to navigate through their transactions with ease. Once users link their PayPal accounts to Cash App, they can send and receive money with just a few taps on their mobile devices. This seamless operation is particularly beneficial for those who engage in frequent transactions, as it reduces the time spent managing finances.

Additionally, Cash App boasts several unique offerings that set it apart from other cash apps. For instance, the platform allows users to purchase stocks and Bitcoin directly within the app, providing a diversified financial management experience. Furthermore, Cash App users can opt for a Cash Card, a physical debit card that can be used for in-store purchases and online payments, enhancing the utility of the app beyond basic cash transfers.

Moreover, Cash App emphasizes security and privacy, offering features such as two-factor authentication and encryption to safeguard user information. This focus on security is particularly important when integrating with other platforms like PayPal, where financial data must be protected during cross-platform transactions. Overall, Cash App stands out due to its compatibility with PayPal, ensuring users enjoy the benefits of quick transactions and enhanced financial capabilities all within a secure environment.

Zelle: Fast Transfers and PayPal Compatibility

Zelle has emerged as a prominent player in the realm of digital payments, offering users the ability to transfer money quickly and efficiently. Operating directly between bank accounts, Zelle facilitates instantaneous transactions, which is particularly valuable for those who require prompt payment solutions. Unlike many services that impose waiting periods, Zelle ensures that funds are available in the recipient’s account almost immediately after the transaction is initiated. This speed of transfer makes Zelle a desirable option for time-sensitive payments.

One of the noteworthy aspects of Zelle is its compatibility with PayPal, allowing users to link their PayPal accounts for added convenience. This integration enables users to send and receive money through Zelle while maintaining their PayPal account for other transactions. To set up this synergy, users need to access their PayPal settings and link their bank account, which is also registered with Zelle. Once connected, users can easily transfer funds between Zelle and PayPal, thereby enhancing their overall payment flexibility.

From a financial standpoint, Zelle provides the additional advantage of fee-free transactions, a key consideration for many users. Unlike other peer-to-peer payment systems that often charge service fees, Zelle’s operation is devoid of such costs, making it an appealing option for transferring money without incurring extra expenses. However, there are certain limitations to consider. Zelle is primarily designed for domestic transactions; thus, international payments are not within its scope. Additionally, users must ensure that their bank supports Zelle to fully take advantage of its features. Overall, the seamless integration between Zelle and PayPal provides users with swift and financial-friendly options for conducting transactions in the USA.

Revolut: A Multifunctional Financial App

Revolut is a versatile financial application that has garnered attention for its extensive array of services designed to cater to modern financial needs. One of its key features is the ability to seamlessly link with PayPal, allowing users to easily manage payments and transfers across their accounts. This integration enhances the user experience by enabling quick transactions and providing access to a broader range of financial services.

In addition to its PayPal functionality, Revolut offers a unique currency exchange feature, which allows users to hold and exchange multiple currencies at interbank rates. This is particularly advantageous for frequent travelers or individuals who engage in international transactions, as it eliminates the high conversion fees typically charged by traditional banks. Furthermore, Revolut supports cryptocurrency transactions, allowing users to buy, sell, and hold various digital currencies within the app. This positions Revolut as a forward-thinking platform that adapts to the growing demand for cryptocurrency features in personal finance management.

However, while Revolut provides numerous benefits, it is essential to be aware of its potential downsides. Users may encounter limitations in certain functionalities based on their geographic location, as specific features may be restricted in certain countries. Additionally, while the app offers free standard services, users must keep in mind that premium features are locked behind subscription tiers, which may not be suitable for everyone. Overall, Revolut stands out as a multifunctional financial app with great potential for those looking to integrate their PayPal account with additional financial tools.

PayPal’s Own Cash Services: An In-House Option

In the realm of digital payment solutions, PayPal stands out with its own suite of cash services designed to enhance user experience. Two prominent features within this offering are PayPal Cash and PayPal Cash Plus. These services not only allow users to manage their funds efficiently but also provide an appealing alternative for those seeking a native solution within the PayPal ecosystem.

PayPal Cash enables individuals to deposit cash directly into their PayPal accounts at various retail locations. Users simply need to obtain a PayPal Cash card, which can be used to facilitate these cash deposits. This feature is particularly advantageous for those who may not have access to traditional banking services or prefer using cash for transactions. Retailers, including convenience stores and drugstores, participate in this network, making the process accessible and convenient.

On the other hand, PayPal Cash Plus extends the functionality of the standard PayPal account. Users are issued a PayPal Cash Plus card, which allows for both cash deposits and online transactions, enabling a seamless experience for managing money within one account. This service not only caters to users wishing to keep their finances organized but also offers additional benefits, such as the ability to add funds via bank transfers and increased transaction limits.

With both PayPal Cash and PayPal Cash Plus, the integration of these services into the existing PayPal framework ensures a streamlined approach to digital transactions. This native option is particularly appealing for current PayPal users who appreciate the convenience of managing their cash and online purchases from a single platform. As digital payments continue to evolve, PayPal’s own cash services remain a solid choice for users looking for efficiency and reliability in handling their finances.

Comparative Analysis of Cash Apps

When evaluating the best PayPal cash apps available in the USA, it’s crucial to examine several key factors that influence user experience and functionality. A comparative analysis facilitates a clearer understanding of these applications, allowing users to select the option that best suits their needs. Below, we outline a comparison of selected cash apps based on criteria such as transaction fees, speed of transfers, user interface, and customer support.

| App Name | Transaction Fees | Transfer Speed | User Interface | Customer Support |

|---|---|---|---|---|

| PayPal | 2.9% + $0.30 per transaction | Instant with a fee; 1-3 business days without | Intuitive and user-friendly | 24/7 support via chat and phone |

| Venmo | No fees for bank transfers; 3% for credit card payments | Instant transfers available | Modern and social-friendly | In-app support, not 24/7 |

| Cash App | No fees for standard transfers; fees apply for instant transactions | Instant transfers available | Simple and straightforward | Email support, limited hours |

| Zelle | No fees | Instant transfers | Clean and minimalistic | Varied by banking institution |

This comparative chart illustrates the varying features and attributes of each app, highlighting that while most options provide user-friendly interfaces and fast transfer speeds, fees can differ considerably. For example, PayPal maintains a professional platform, but its transaction fees may deter cost-conscious users. Venmo’s social aspects appeal to younger audiences, while Cash App provides a balanced combination of functionality and ease of use. Zelle emerges as a valuable choice for those seeking fee-free transactions, though its availability may be dependent on individual banks.

Tips for Using Cash Apps Safely with PayPal

Ensuring safe transactions while using cash apps with PayPal is crucial for protecting your financial information. One of the primary measures to adopt is implementing strong password protection. Always create unique, complex passwords that combine letters, numbers, and symbols. Avoid using easily guessable information such as birthdays or common words. Additionally, it is advisable to enable two-factor authentication (2FA) whenever possible. This adds an extra layer of security by requiring not only a password but also a verification code sent to your phone or email.

Another significant aspect of safe online transactions is being vigilant and avoiding scams. Be cautious when dealing with unfamiliar individuals or entities. Scammers often exploit cash apps by impersonating legitimate businesses or offering deals that seem too good to be true. Always verify the identity of anyone you transact with and trust your instincts; if something feels off, it is best to refrain from proceeding. Furthermore, avoid sharing personal financial information via messaging apps or social media, as these platforms can lack encryption and security.

Keeping your cash app and PayPal software updated is also a best practice for online security. Software updates often include essential security patches and improvements that protect against evolving threats. Ensure that notifications for updates are enabled, and regularly check for any updates deviating from the standard schedule.

Finally, recognize secure transactions by ensuring that both the cash app and PayPal URLs begin with “https://” rather than just “http://”. The “s” signifies that the website uses encryption to protect sensitive data during transmission. This simple check can help safeguard your financial information while using cash apps with PayPal, providing you peace of mind in your transactions.